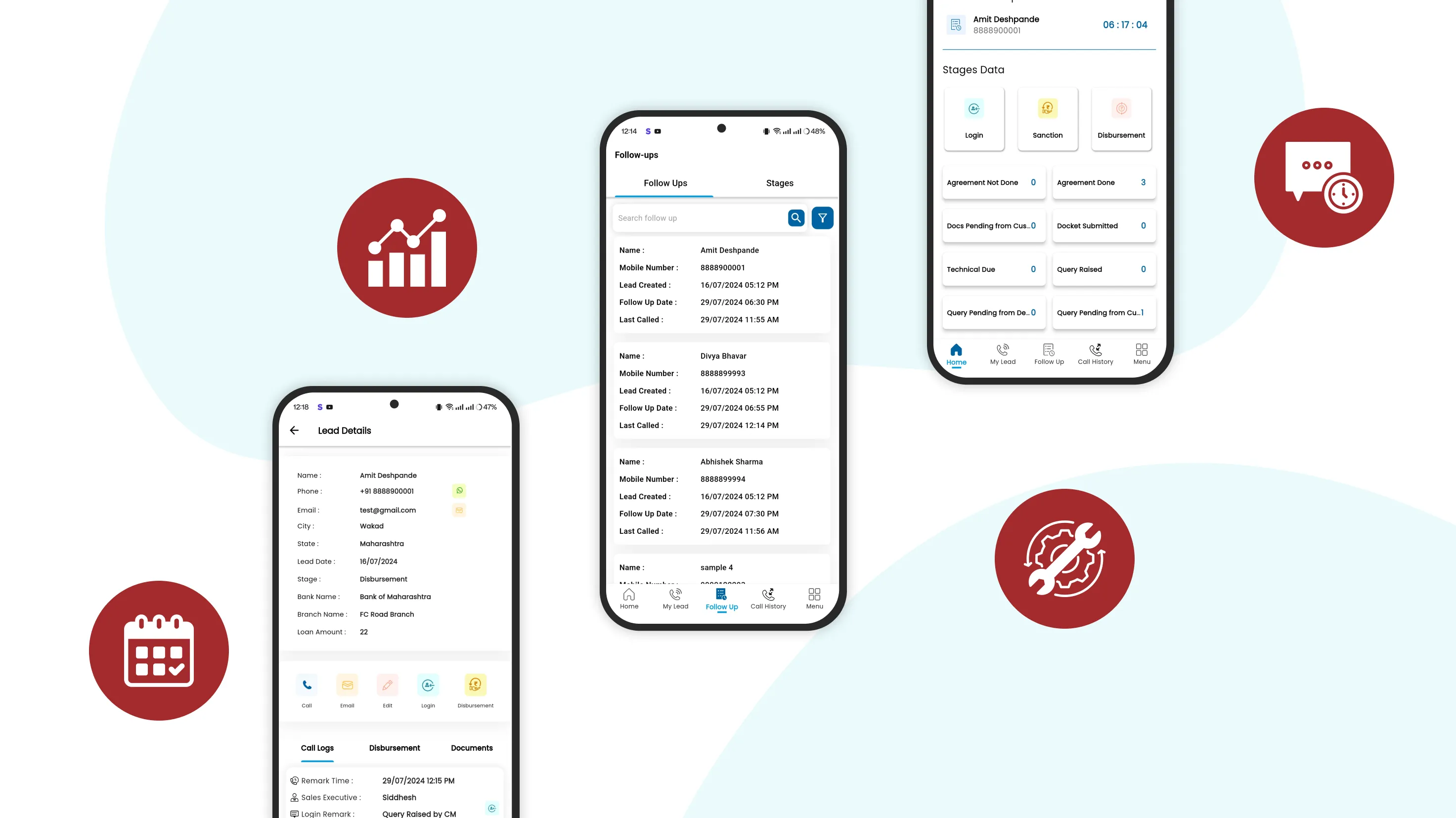

Ahmednagar Merchant's Co-operative Bank

A comprehensive digital banking platform that seamlessly blends 50+ years of banking heritage with cutting-edge web technology, serving thousands of customers with secure, responsive, and user-friendly banking services.