Sellon Finserv - Complete Loan Distribution CRM

Transforming Mortgage Loan Operations from Chaos to Clarity

Transforming Mortgage Loan Operations from Chaos to Clarity

Sellon Finserv is a new-age loan distribution company serving as a one-stop solution for mortgage products. They partner with multiple banks, Housing Finance Companies (HFCs), and Financial Institutions to deliver the best experience to developers, customers, and channel partners. Their product portfolio includes home loans, mortgage loans, construction finance, commercial premises loans, and more.

Sellon Finserv was growing rapidly, receiving leads from developers, website inquiries, and sales partners. However, managing these leads through the complex loan processing journey became increasingly chaotic using traditional CRM systems.

Critical Pain Points:

Generic CRMs Don’t Fit Lending Operations: Traditional CRMs like Salesforce or Zoho weren’t designed for loan processing workflows. The linear sales pipeline didn’t match the complex, multi-stage loan approval and disbursement process. Custom stages and conditional flows required excessive workarounds. No built-in support for loan-specific concepts like disbursement schedules, construction stages, or bank approvals.

Lead Management Chaos: Leads arrived from multiple sources - developers, website forms, partner referrals, walk-ins. No centralized system to capture and route leads appropriately. Sales team used mix of Excel, WhatsApp, and memory to track leads. Lead response time was slow as assignments were manual. No visibility into lead status for management or partners.

Document Collection Nightmare: Gathering required documents from customers was extremely painful. Loan officers chased customers via WhatsApp for each document. Customers confused about what documents were needed when. Documents received via WhatsApp, email, and physical copies scattered everywhere. No tracking of which documents were pending or received. Version control issues with multiple document uploads.

Stage-Based Disbursement Complexity: Construction loans disburse in stages (foundation, structure, finishing, etc.). Tracking disbursement against project stages was manual and error-prone. No systematic workflow for stage verification and approval. Reconciliation between bank disbursements and project stages was nightmare.

Commission Calculation Hell: Calculating commissions for channel partners and employee incentives consumed days every month. Each bank/HFC had different commission structures. Growth partners (external agents) had varying agreements. Manual Excel calculations led to errors and disputes. No transparency - partners couldn’t see their earnings in real-time. Payment delays due to reconciliation issues.

Field Operations Not Tracked: Site visits by loan officers to developers or customers weren’t systematically tracked. Attendance and field activity visibility was zero. Management had no way to verify claimed site visits. Performance evaluation was subjective without activity data.

Partner Management Issues: Growth partners (external agents) had no visibility into their loan pipeline. No way for partners to track commission status. Communication with partners was fragmented. Onboarding new partners took weeks due to manual processes.

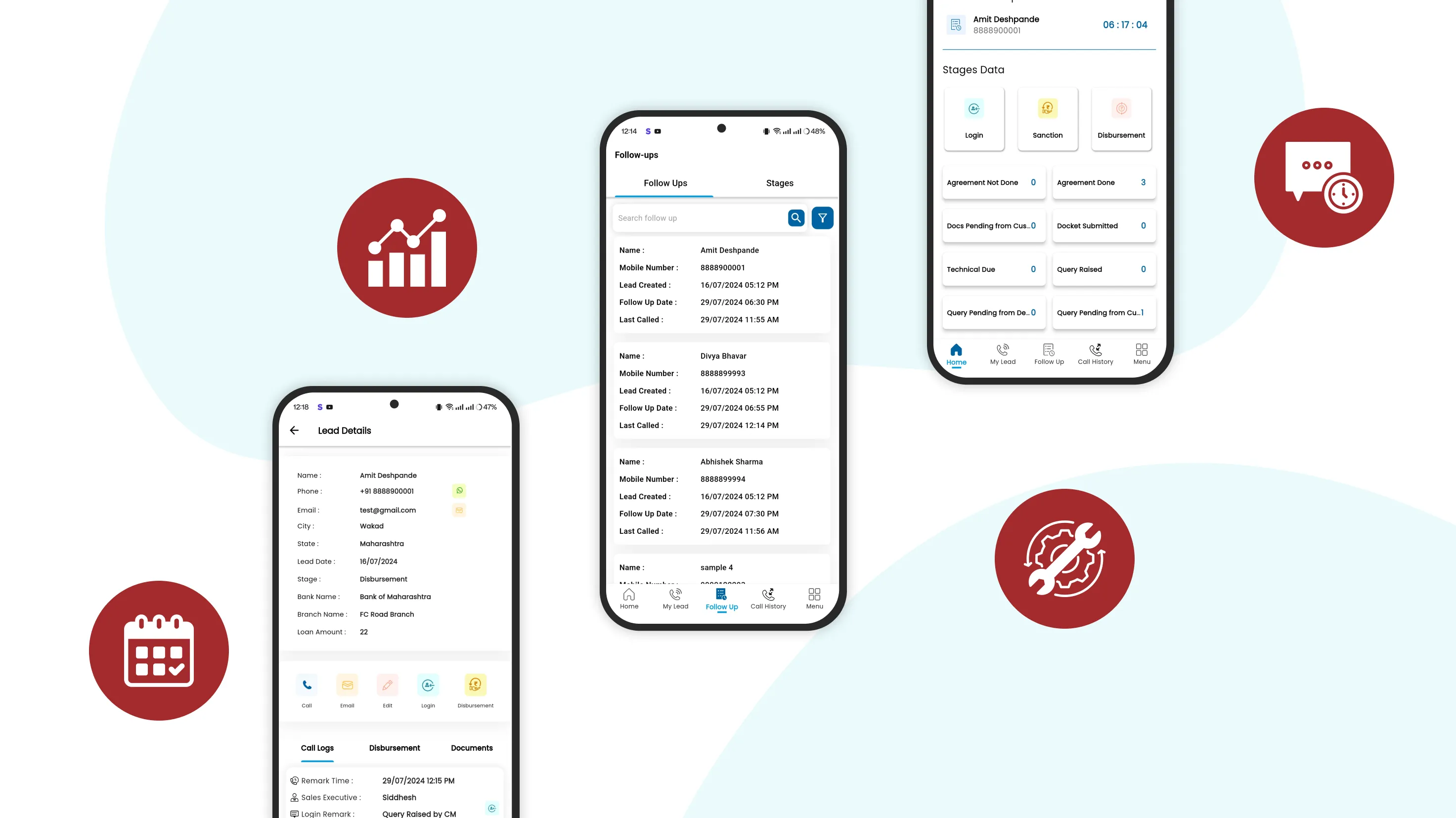

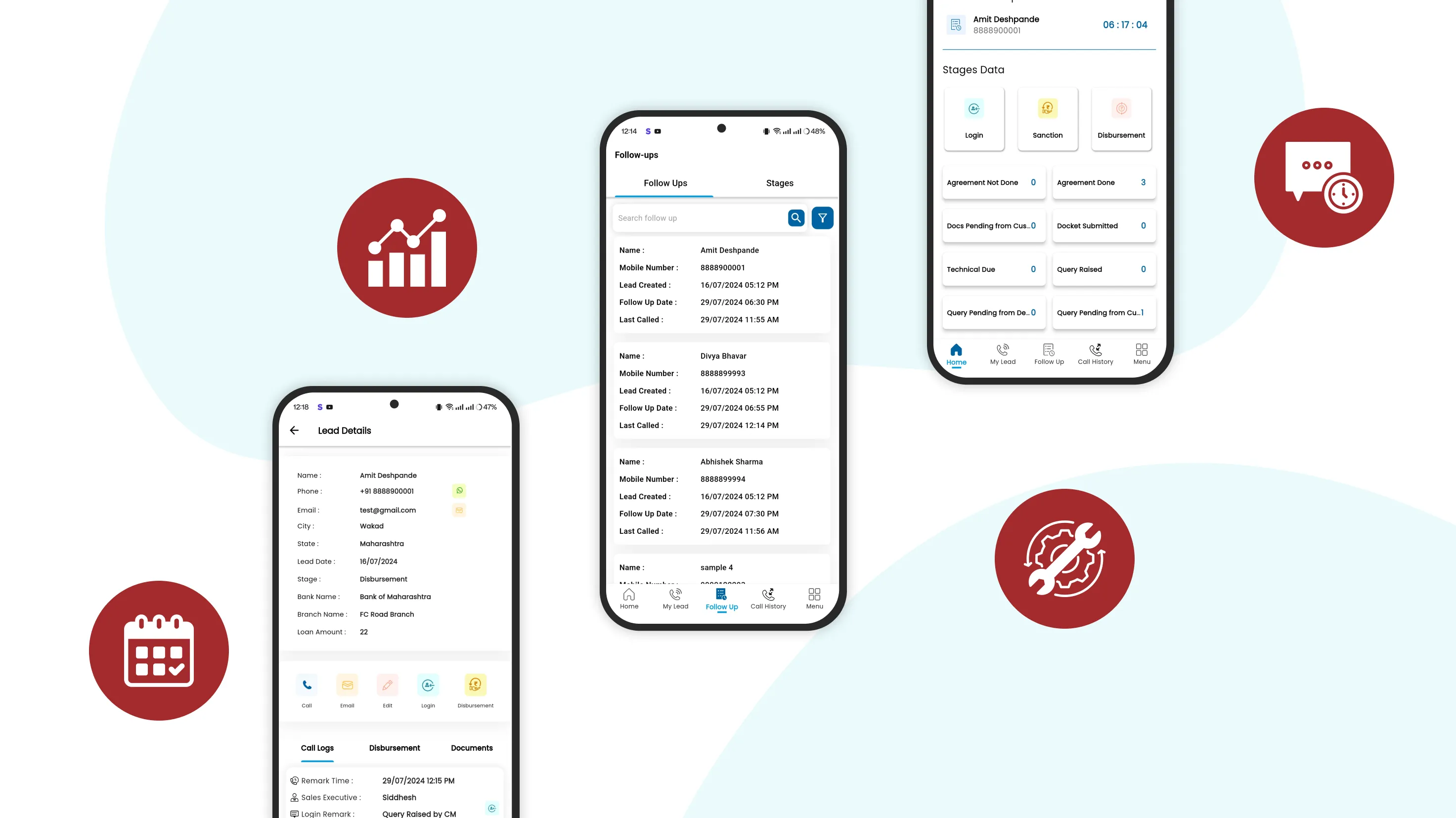

We built a comprehensive loan distribution CRM specifically designed for mortgage lending operations - combining web dashboard for management and mobile app for field operations, all centered around Sellon Finserv’s unique workflows.

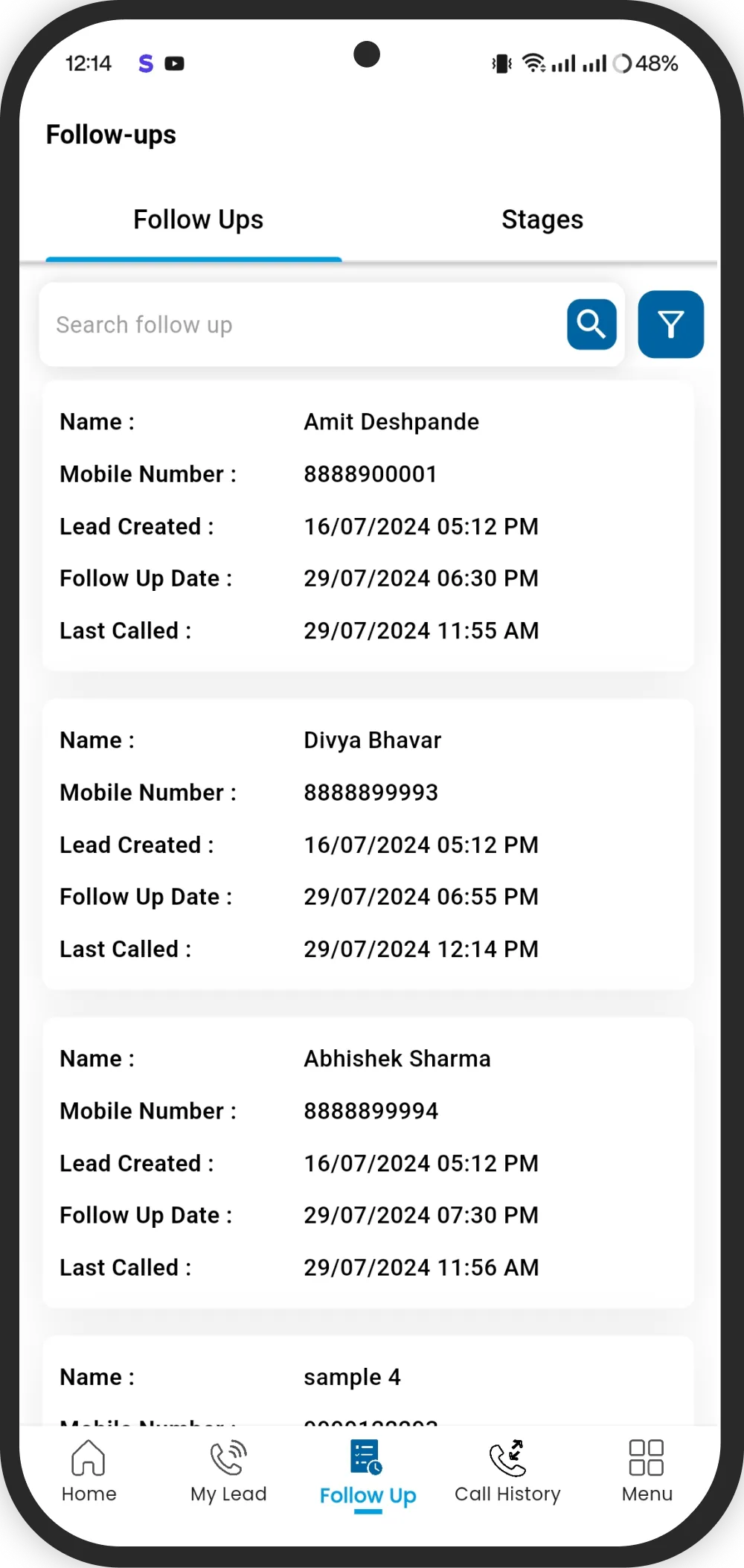

Multi-Source Lead Management

We created a centralized lead capture and routing system handling all lead sources seamlessly.

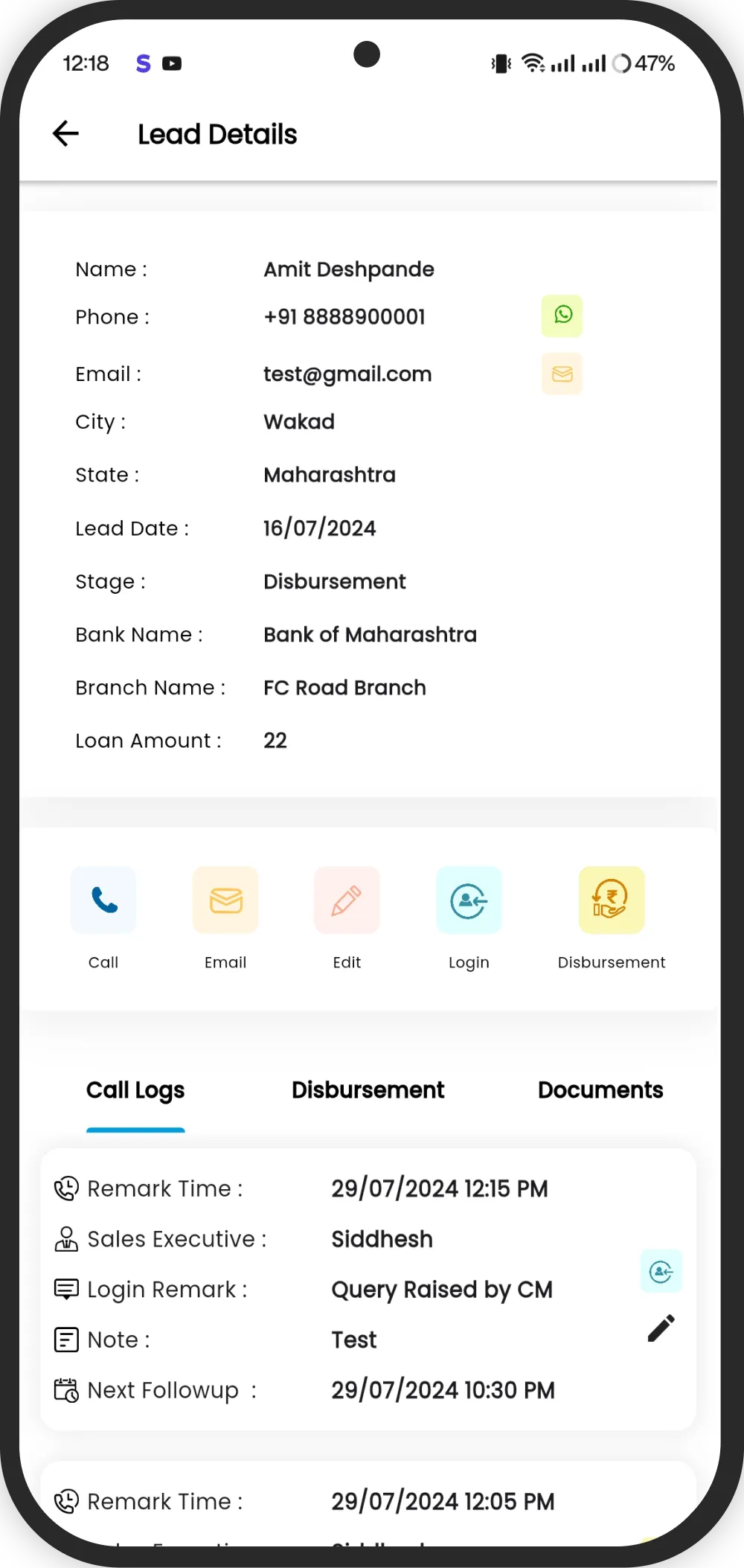

Lead Capture: Mobile app for instant lead entry by field staff from developer sites or customer meetings. Web form integration capturing website inquiries automatically. API for partner portals to push leads directly. Bulk lead import from Excel for campaigns or events. Each lead tagged with source for tracking ROI.

Intelligent Lead Routing: Automatic assignment based on geography, loan type, or load balancing. Manual assignment for special cases or VIP leads. Lead transfer capability with complete history retention. Queue management showing pending lead assignments.

Lead Enrichment: Capture comprehensive customer information - loan type, amount, property details, income. Auto-populate property details from developer master data. Credit score integration for preliminary assessment. Related leads detection preventing duplicate follow-ups.

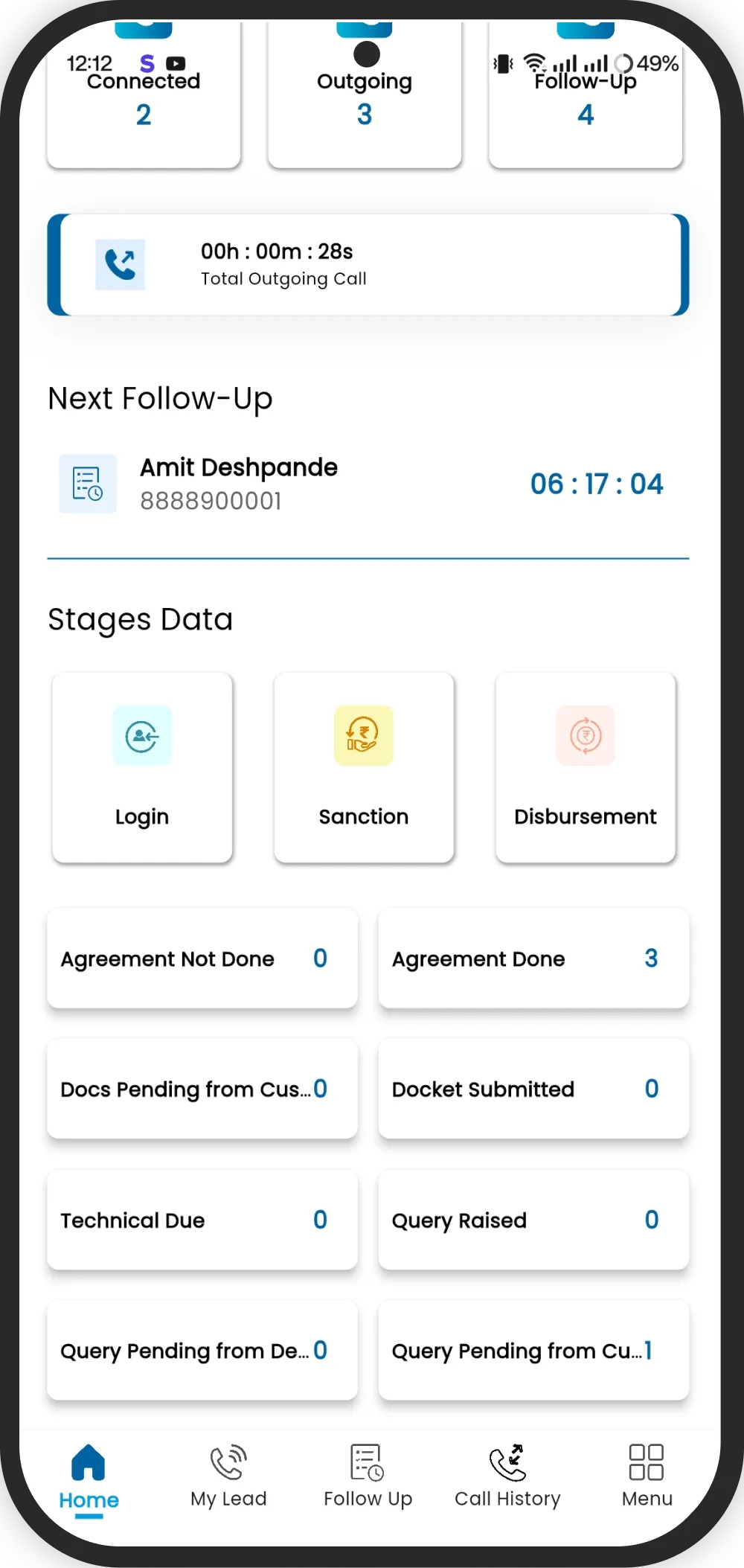

Custom Loan Processing Stages

Rather than forcing loan workflows into generic CRM stages, we built a completely customizable stage management system.

Flexible Stage Configuration: Define unlimited stages matching your exact loan process. Common stages: Lead Generated → Document Collection → Credit Check → Bank Submission → Bank Approval → Legal Verification → Sanction → Disbursement. Stage-specific fields and requirements. Conditional stages based on loan type (home loan vs construction finance).

Stage Progression: Mobile app shows current stage and next actions clearly. One-tap stage update with mandatory remarks/documents. Approval workflows for critical stage transitions. Automatic notifications to stakeholders on stage changes. Stage history audit trail showing who moved when and why.

Stage-Based Reminders: Automatic alerts if loan stuck in a stage beyond threshold. Escalation to manager if no progress after defined period. Customer communication triggered on stage milestones. Weekly stage-wise pipeline review reports.

Stage-Based Disbursement Tracking

Construction loans require sophisticated disbursement management tied to project completion stages.

Disbursement Schedule: Define disbursement schedule during loan sanction - percentages per stage. Stages like land purchase, foundation, plinth, roof, finishing, completion. Link each disbursement to project milestone verification. Bank-wise disbursement terms configuration.

Stage Verification: Field officer visits site and verifies stage completion. Upload photos and inspection reports as proof. Architect or engineer approval workflow for stage sign-off. QR code-based verification at construction sites preventing fraud.

Disbursement Processing: Automatic calculation of disbursement amount based on stage and sanction. Bank API integration for disbursement request submission. Track disbursement status from request to customer account credit. Reconciliation of bank disbursement with internal records.

Progress Tracking: Visual timeline showing planned vs actual stage completion. Delay analysis highlighting stuck disbursements. Customer portal showing disbursement schedule and received amounts. Developer portal for construction finance tracking multiple units.

Customer Document Collection Portal

Eliminated WhatsApp chaos with a professional, customer-friendly document upload system.

Document Checklist: Loan type-specific document checklist auto-generated. Clear descriptions of what each document should contain. Sample document images helping customers understand requirements. Priority marking for urgent vs. nice-to-have documents.

Easy Upload Flow: Unique link sent to customer via SMS and email. Mobile-optimized upload interface - capture with camera or upload from gallery. Support for multiple file formats - PDF, images, documents. Document category selection for organized collection. Progress indicator showing completion percentage.

Document Management: Auto-notification to loan officer when customer uploads documents. Document verification workflow - approve, reject, or request re-upload. Rejection reasons communicated clearly to customer. Version tracking when documents re-uploaded. Secure storage with encryption and access controls.

Customer Communication: Automated reminders if documents pending beyond threshold. WhatsApp notifications with upload link for convenience. Email summary of received and pending documents. Thank you confirmation when all documents received.

Automated Commission Management

Completely automated partner and employee incentive calculations eliminating manual work and errors.

Commission Structure Configuration: Define commission rules per bank/HFC/financial institution. Percentage-based or flat fee structures. Loan type-specific commission rates. Tiered commissions based on loan value brackets. Growth partner vs employee incentive structures.

Automatic Calculation: Commission computed automatically when loan disbursed. Handling split commissions when multiple partners involved. Pro-rata calculation for part-disbursements. Adjustments for cancellations or pre-closures. GST and TDS calculation where applicable.

Partner Commission Dashboard: Growth partners view real-time earnings through mobile app. Bank-wise commission breakdown showing rates and amounts. Pending vs received payment tracking. Invoice generation for payment requests. Historical earnings and performance metrics.

Employee Incentive Tracking: Loan officers see incentive pipeline in app. Target vs achievement tracking by month/quarter. Leaderboard creating healthy competition. Incentive payout statements with detailed breakup.

Payment Processing: Approval workflow for commission payments. Bulk payment processing with bank file generation. Payment reconciliation and confirmation. Commission statement generation for accounting.

Growth Partner Management

External channel partners are critical for lead generation - we built complete partner lifecycle management.

Partner Onboarding: Self-registration with document upload (PAN, Aadhaar, certificates). KYC verification workflow for compliance. Commission agreement management with digital signatures. Partner training and certification tracking.

Partner Portal (Mobile App): Dedicated login for growth partners. Create and submit leads directly from app. Track status of their submitted leads in real-time. Commission visibility as discussed above. Performance analytics showing conversion rates.

Partner Communication: Push notifications for lead updates and commission credits. Promotional material and product update sharing. Rate card updates reflected instantly in app. Partner feedback and support ticket system.

Partner Performance: Conversion rate analysis by partner. Source-wise lead quality metrics. Revenue contribution by partner. Inactive partner identification for re-engagement.

Field Operations Management

Bringing transparency and accountability to field activities.

Attendance Tracking: Mobile app attendance marking with GPS location. Photo verification preventing proxy attendance. Shift timings and late arrival tracking. Leave application and approval workflow. Monthly attendance reports for payroll.

Site Visit Tracking: Mark site visit to customer location or developer site. GPS verification ensuring actual visit happened. Upload visit photos and notes. Customer/developer signature capture as proof. Purpose of visit tracking - document collection, property inspection, relationship building. Visit duration calculation. Daily visit schedule and route optimization.

Activity Logging: Log all customer interactions - calls, meetings, WhatsApp chats. Time spent per lead/customer for productivity analysis. Travel expense logging with bill uploads. Daily activity summary for manager review.

Performance Metrics: Visit count vs conversion correlation. Average time to loan closure by officer. Customer satisfaction scores. Monthly performance scorecards.

Analytics & Business Intelligence

Management Dashboard: Real-time loan pipeline by stage with values. Conversion funnel from lead to disbursement. Bank-wise performance comparison. Officer-wise productivity metrics. Month-on-month growth trends. Stuck loan identification with aging analysis.

Lead Source ROI: Cost per lead by source (developers, digital, partners). Conversion rate by source. Revenue generated per source. Partner-wise lead quality comparison.

Operational Metrics: Average loan processing time by loan type. Bottleneck identification - which stages take longest. Document collection efficiency. Disbursement cycle time. Customer drop-off points in the journey.

Financial Reports: Commission payables by period. Revenue forecast based on pipeline. Loan portfolio composition. Target vs achievement tracking.

Backend: Node.js providing scalable API infrastructure for web and mobile clients. RESTful API architecture with proper authentication and authorization. Microservices for lead management, document handling, commission calculation, and notifications.

Database: MongoDB for flexible schema supporting varying loan types and stages. Document-based storage perfect for loan applications with varying fields. Efficient querying for pipeline reports and analytics. Indexed searches for fast lead lookup.

Mobile App: Flutter for native Android and iOS apps sharing single codebase. Offline-first architecture allowing field work without connectivity. Background sync updating data when connection available. Camera integration for document capture and site photos. GPS integration for attendance and visit verification.

Cloud & Storage: AWS hosting providing reliability and scalability. S3 for secure document storage with encryption. CloudFront CDN for fast document access. Load balancing for handling traffic spikes. Automated backups and disaster recovery.

Real-Time Features: Firebase for push notifications keeping all stakeholders updated. Real-time database sync for instant dashboard updates. WebSocket connections for live stage updates. Background job processing for commission calculations and email notifications.

Security: SSL encryption for all data transmission. Role-based access control - admin, manager, loan officer, partner. Document encryption at rest. Audit logging of all sensitive operations. Compliance with financial data protection regulations.

Operational Efficiency

Revenue Growth

Partner Satisfaction

Employee Productivity

Customer Experience

Management Visibility

Mr. Prashant Jogi, Owner Testimonial

1. Built for Lending, Not Adapted: Rather than customizing a generic CRM, we built specifically for loan distribution workflows - stage-based processing, disbursement tracking, commission structures native to the platform.

2. Mobile-First for Field Teams: Loan officers spend most time in the field. Building mobile app as primary interface rather than afterthought ensured high adoption and productivity.

3. Solving Document Collection: The customer document portal addressed one of the most painful aspects of loan processing, creating immediate value that drove adoption.

4. Partner Transparency: Making commissions visible to growth partners in real-time built trust and strengthened the partner network critical for lead generation.

5. Automation of Tedious Tasks: Automating commission calculation, reminders, and reporting freed up significant time for revenue-generating activities.

6. Flexibility in Configuration: Custom stages, commission structures, and workflows meant the system adapted to Sellon’s processes rather than forcing process changes.

Offline Functionality: Field officers often work in areas with poor connectivity. Built robust offline-first architecture with intelligent sync preventing data loss.

Complex Commission Logic: Multiple stakeholder types, varying bank agreements, and split commission scenarios required sophisticated calculation engine with audit trail.

Document Security: Handling sensitive financial documents required encryption at rest and in transit, secure access controls, and compliance with data protection regulations.

GPS Accuracy: Site visit tracking needed to balance accuracy with user experience. Implemented fuzzy matching and manual override for legitimate cases while preventing fraud.

Scale Handling: System needed to handle growing loan volume without performance degradation. MongoDB sharding and query optimization maintained sub-second response times.

Sellon Finserv demonstrates our expertise in building specialized CRM solutions for financial services where generic platforms fall short. Whether you’re in lending, insurance, wealth management, or other financial services, we understand the unique workflows and can build systems that enhance rather than hinder your operations.

What We Can Build For You:

Loan origination and processing systems, mortgage lending platforms, insurance CRM and policy management, wealth management and client portals, commission and incentive management, field operations and sales force automation, partner and channel management, document management with compliance, and custom financial workflows.

Let’s discuss your operational challenges and build a system that fits your business perfectly rather than forcing you into generic templates.

Explore more of our work